What We Offer

Dive into a new world of opportunities and discover a full range of financial products and services tailored to bring your business to another level. Set an objective, and let us bring you there safely.

CREDIT

We help you grow the business of your dreams. To ensure uninterrupted business operations or to drive your expansion plans, we walk by your side with loan products designed to match your capacity.

Our products are flexible, affordable, convenient and accessible. Whether you run a micro or small enterprise, we have an adapted solution to keep you running.

Micro Loan

Do not allow your business to starve for funds. Our loans for small businesses are tailored to boost your productivity and help you grow your business efficiently and in a sustainable manner.

You can access a loan from as low as 200,000 Rwandan Francs up to 5 Million Rwanda Francs. Apply and access your loan in less than 5 days.

Features

- Maximum maturity of micro loan up to 24 months

- No registration of the collateral requirement

- Micro loan is disbursed in less than 3 days.

- Flexible document and collateral requirement.

Super Micro Loan

Running your business can be challenging. To sustain growth, you need a reliable partner walking by your side. We put at your disposal advantageous loans for micro businesses starting from 5 Million Rwanda Francs up to 30 Million Rwanda Francs.

Features

- Maximum maturity up to 36 months

- No mandatory deposits/savings

- No audited financial statements required

- Flexible Hard collateral to be registered in RDB

- Super Micro loan is disbursed in less than 10 days.

Agro Loan

This loan is intended for individuals in rural and semi-urban areas and whose income is mainly generated from agriculture, farming, fisheries, agricultural-processing or any other agricultural-farming related activity. The agro loan comes with substantial advantages such as a flexible payment schedule tailored to seasons.

Features

- Ownership of cultivating area (plot)

- Agro Loan is disbursed in less than 3days

- Amount from 200K up to 5M

- Quarterly or biannual payment schedule upon harvest

- Collateral to be that plot for cultivating

- Maturity up to 12months

Documents required for a loan application:

- Your Rwanda National Identification document

- Business patent or Tax declaration showing that your business has been operating for at least one year

- Your cosigner’s Rwanda National Identification document

- Your guarantor’s Rwanda National Identification document

- Your business’s rental agreement

Other documents might be required during assessment.

Consult our tariff guide, or for more details, contact us.

Loan Calculator

*Results received from this calculator are estimates and are designed for comparative purposes only, accuracy is not guaranteed. Contact us for Agro Loans.

Loan Calculator Input

Bancassurance

Invest in your future knowing that the ones you love are protected. With NGOBOKA insurance, you confidently and peacefully focus on your daily activities.

NGOBOKA: Benefits Beyond Life Expectancy

Peace of mind is a universal leitmotiv and everyone feels the need of being adequately protected as life is by nature unpredictable.

NGOBOKA policy offers you flexibility to choose between different options. You can opt for an Individual Scheme (starting from 400 Rwf per month) where you are the sole person under NGOBOKA coverage or include your family members under the Family Scheme (starting from 900 Rwf per month), which enables you to extend coverage to your spouse and a maximum of four kids aged under 25.

Contact us or visit one of our branches to get all additional information you need about NGOBOKA.

Banking Services

AB BANK offers you a fully-fledged range of banking services that blend perfectly with your aim to be productive and efficient. We strive to offer you smart tools to empower you in your daily activities. In everything we do, we have you in mind!

Visit our tariff section for more details or contact us.

Accounts

Reach your savings goals with AB BANK RWANDA. Take advantage of our competitive rate to maximize your money. No matter what your savings goals are, we have an account to help you get there.

For more details, contact us and talk to our advisors.

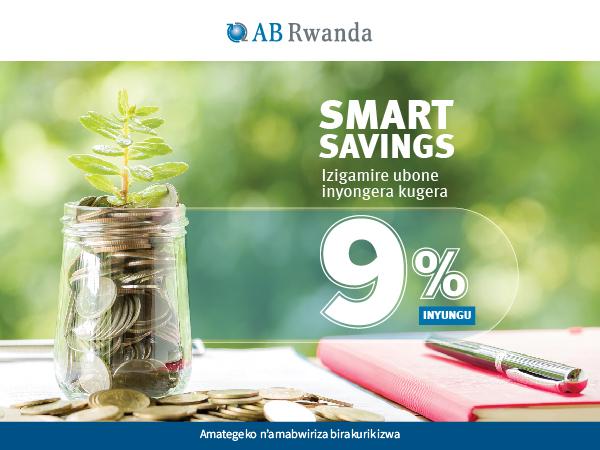

Term Deposit

Lock away an amount of money for an agreed length of time and we guarantee the interest rate you will be receiving for the term you select. IGIRE Term Deposit Account returns an attractive interest rate ranging from 6% to 9%. Invest your money and let time work!

Key Features

Attractive annual interest rates: 6% – 9%

Affordable minimum deposit of RWF 50,000 for individuals and RWF 100,000 for legal entities (no maximum limit)

Possibility of renewal or roll-over upon maturity

Free account statement

Ongera Saving Account

Start your saving journey with Ongera Accout. Break down your objectives into small easy steps and save at your own pace. With minimal opening balance of 1,000 rwf, your savings will return an interest of 3.5% per year. ONGERA, more savings, more freedom!

Key feafures

- Rw 1,000 Minimum opening balance

- No limited monthly withdrawals

- 3.5% interest per annum

Current Account

Experience quick, convenient and efficient banking with ISANGE account. Whether you have extensive or simple banking needs, ISANGE is designed to offer a unique combination of benefits and options. Pay bills, send money, make purchases, and manage your cash flow efficiently and conveniently for an affordable maintenance fee of only 800 Rwf per month.

Paired with AB IBAKWE, access your funds from anywhere using your MTN mobile wallet. Send money to and from your Isange account without boundaries.

Set up Direct Deposit to get any payments deposited directly into your Isange current account. You get notified by SMS . The fee varies between 200_1000 depends on the transactions done.

Key Features

Payroll processing

Standing orders

Transaction processing via email

Sms notifications

Cheque books and Push & Pull service

Local Tranfers

Enjoy painless fund transfers by choosing a method that is easy for you and convenient for your recipient, whether it is directly to their bank account or for cash pick up with MoneyGram. We provide competitive rates on all transfers, both local and international.

Digital Solutions

Bank the smart way with our digital solutions. Enjoy boundless access to our services using secured channels at any time and from anywhere. We strive to offer you the best banking experience by making things convenient for you.

Mobile Banking( Ekash)

Your account in your hands!

Welcome to AB MOBILE, our digital financial channel that enables our customers to access their bank account information anytime, anywhere and from the comfort of their mobile phones by simply dialing *540#

With AB Mobile, our active current accounts and Ongera Saving accounts holders can now:

• Self-register to use this service

• Check their account balance

• View account transaction history (Mini-Statement)

• Change language (Kinyarwanda and English)

• Change their PIN code

The Service is currently available on MTN network and works on all types of mobile phones (basic and smartphones).

Benefits of using this service

- A user can check his/her account balance

- A user can see the transactions done( Mini statement)

- A user can send money from one account to another one within AB Rwanda

- A user can transact instantly( receiving and sending money) between AB Rwanda accounts to other Local banks accounts/Mobile wallets( eKash)

- To access this service, dial *540#

For more information, please read the Terms and Conditions.

AB Ibakwe( Push & Pull)_ Stay Connected With Your Bank!

Turn your phone into a powerful device that gives you full control of your finances. With AB IBAKWE you can send funds from your bank account to your MTN mobile wallet (Momo) and vice versa. The power is in your hand. It is simple, user-friendly and very convenient.

Benefits of using this service

- A user can transfer money from Mobile money wallet to AB Rwanda account(push)

- A user can transfer money from AB Rwanda account to mobile money wallet(pull)

- A user can pay loan without necessarily coming to our branch and save time.

To access this service, dial *182*4# and follow the instructions.

For any questions related to AB IBAKWE, please contact us or consult ABBY, our virtual assistant available 24/7.